3.22% $12.52 45.24% 10.76% 9 Years

Dec 31, 2018

Stock Buy - BlackRock (3 shares, $37 div income)

3.22% $12.52 45.24% 10.76% 9 Years

Dec 21, 2018

Stock Buy - Williams-Sonoma, Inc. (25 shares, $43 div income)

Another market down day and I added discounted shares of a unique retailer 😇💪

Williams-Sonoma, Inc. (NYSE:WSM) is a specialty retailer of high quality products for the home.

MARKET CAP DIV/YIELD (FWD) PAYOUT RATIO 5 YR DGR DIV GROWTH

$3.8B $1.72 (3.60%) ~39% ~11.8% 12 Years

Williams-Sonoma, Inc. (NYSE:WSM) is a specialty retailer of high quality products for the home.

MARKET CAP DIV/YIELD (FWD) PAYOUT RATIO 5 YR DGR DIV GROWTH

$3.8B $1.72 (3.60%) ~39% ~11.8% 12 Years

Dec 17, 2018

A Journey: Four Rooms Buffet - Osaka, Japan

A Journey: Four Rooms Buffet - Osaka, Japan: The day we traveled from Kyoto to Osaka was a hot sunny day. It was probably normal temperature for that time of the year in Osaka. ...

Stock Buys - EGP (10 shares, $28 dividend), PLD (15 shares, $28 dividend)

Today was a market down day for the REIT sector so I decided to go shopping.

EastGroup Properties (NYSE:EGP) focuses on multi-tenant business distribution buildings.

Basic info:

Market CAP: 3.5B Dividend: $2.88 (2.9%) Payout Ratio: 68% 5yr DGR: 3.7%

Prologis (NYSE: PLD) manages logistics and distribution centers in the Americas, Asia and Europe.

Basic info:

Market CAP: 38B Dividend: $1.92 (2.96%) Payout Ratio: 69% 5yr DGR: 9.4%

These 2 purchases will add $56 div income annually to my dividend stock portfolio 💪

EastGroup Properties (NYSE:EGP) focuses on multi-tenant business distribution buildings.

Basic info:

Market CAP: 3.5B Dividend: $2.88 (2.9%) Payout Ratio: 68% 5yr DGR: 3.7%

Prologis (NYSE: PLD) manages logistics and distribution centers in the Americas, Asia and Europe.

Basic info:

Market CAP: 38B Dividend: $1.92 (2.96%) Payout Ratio: 69% 5yr DGR: 9.4%

These 2 purchases will add $56 div income annually to my dividend stock portfolio 💪

Dec 4, 2018

$Save More, $Spend Less

A Flattening Yield Curve seems to point to a slowdown.

Short term interest rates looking better for savers. (When Will Interest Rates Go Up?)

Time to $ave up and wait for better deals. 😅🎰🎲📈

Market & Housing Slowdown News:

What A Yield Curve Inversion Means For Traders (Benzinga)

Short term interest rates looking better for savers. (When Will Interest Rates Go Up?)

Time to $ave up and wait for better deals. 😅🎰🎲📈

Market & Housing Slowdown News:

What A Yield Curve Inversion Means For Traders (Benzinga)

Nov 29, 2018

Google FI ($20 credit referral link)

https://

I've used Google FI for the past 2 years bcos it's flexible and inexpensive.

Use this link ==> g.co/fi/r/TCW3FP to get a $20 Fi credit (I get $100 )

)

I've used Google FI for the past 2 years bcos it's flexible and inexpensive.

Use this link ==> g.co/fi/r/TCW3FP to get a $20 Fi credit (I get $100

)

) Nov 21, 2018

Getting High - Legalized Weed (CGC, STZ, SMG)

Legalized weed is fast becoming an investment opportunity. These 3 companies offer varying risks and I'm following closely how they perform going forward.

Short volatile history with potential perhaps !?

Big beer company with share of (NYSE: CGC), decent 1.5% div yield , indirect weed play and safer.

The Scotts Miracle-Gro Company (NYSE: SMG)

Very old and established fertilizer company with long history, trying their hand at weed.

I like their stability and dividend history but new side weed business not going well.

Nov 19, 2018

Nov 1, 2018

BTFD - Chinese Stocks !

These chinese stocks have been hammered lately with US & China trade war talks.

Time to get some with these big discounts ! 🙏🙏🙏🎲😂

Aug 29, 2018

Crazy Rich Yields$ ! (AGNC, NLY, NRZ, PSEC, TWO)

I'm holding these names purely for income only. Any price appreciation is a big bonus and not expected. It has only has been a short holding period (ranging from 3-5 yrs) so my results have been mixed (not terrible or fantastic), just mixed.

I will continue to chase these "Crazy RichAsians Yield$" to see if it can boost my income returns. Well, why would I do that you ask ? Bcos this blog is called "Guinea Pig for Life" 🐖😜

I will continue to chase these "Crazy Rich

AGNC Investment Corp. (Yield 11.1%)

Annaly Capital Management, Inc. (Yield 11.2%)

New Residential Investment Corp. (Yield 10.8%)

Aug 28, 2018

Stock Buy - ITW (10 shares, $40 dividend income)

Illinois Tool Works Inc. (NYSE: ITW) produces engineered fasteners and components, equipment and consumable systems, and specialty products.

ITW is a S&P 500 Dividend Aristocrat with over 25+ years of dividend increases. It derives revenues from various market segments and it is quite diversified.

ITW is a S&P 500 Dividend Aristocrat with over 25+ years of dividend increases. It derives revenues from various market segments and it is quite diversified.

Recent pullback in price has provided a good opportunity to get a few shares of this consistent dividend payer. I hope to keep receiving and growing this dividend income for a long time.

This purchase will add $40 div income annually to my dividend stock portfolio 💪

This purchase will add $40 div income annually to my dividend stock portfolio 💪

Basic info:

Market CAP: 46B EPS:$7.42 Dividend: $4.00 (2.89%)

Aug 17, 2018

Buying "Cannibis" - SMG (15 shares, $33 dividend income)

The Scotts Miracle-Gro Company (NYSE: SMG) is the world's largest marketer of branded consumer lawn and garden products.

This company provides a way to invest in the legalization of cannibis trend in North America. It's subsidiary, Hawthorne Gardening Company, formed in October 2014 was created "to meet the demands of hydroponic growers" (a.k.a. cannabis growers) (src: wikipedia)

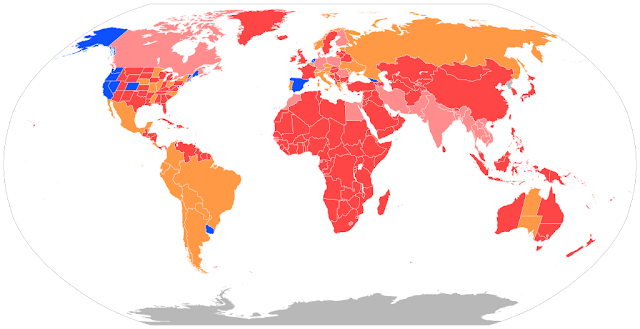

Cannibis laws and its implementation in various countries and regions are still in progress so this is a speculative investment.

Current pullback in the whole agriculture sector especially because of US tariffs rumors has provided a good entry price into this name. As long as they maintain their consistent dividend (~2.9%) and revenues going forward, I will wait patiently for them to go much "higher" !

This purchase will add $33 div income annually to my dividend stock portfolio 💪

Cannibis laws and its implementation in various countries and regions are still in progress so this is a speculative investment.

Legality of Cannibis across the World

Current pullback in the whole agriculture sector especially because of US tariffs rumors has provided a good entry price into this name. As long as they maintain their consistent dividend (~2.9%) and revenues going forward, I will wait patiently for them to go much "higher" !

This purchase will add $33 div income annually to my dividend stock portfolio 💪

Basic info:

Market CAP: 2.3B EPS:$2.81 Dividend: $2.20 (2.9%)

Aug 15, 2018

Aug 9, 2018

Aug 4, 2018

Jul 27, 2018

Stock Buy - Kimco (80 shares, $89 dividend income)

Kimco Realty Corp. (NYSE: KIM) is a REIT that owns and operates hundreds of shopping centers comprising 79 million square feet of leasable space primarily concentrated in the top US major metropolitan markets.

Recent downturn in the whole REIT and retail sector has provided a good entry point into this proven dividend payer (>6% div).

This purchase will add $89 div income annually to my dividend stock portfolio 💪

This purchase will add $89 div income annually to my dividend stock portfolio 💪

Basic info:

Market CAP: 7B EPS:$0.68 Dividend: $1.12 (6.7%)

Jul 22, 2018

Stock Buy - AVGO (5 shares, $35 dividend income)

Broadcom (formerly Avago Technologies) [NASDAQ : AVGO] is a designer, developer and global supplier of products based on analog and digital semiconductor technologies within four primary markets: wired infrastructure, wireless communications, enterprise storage, and industrial & others.

Nasty drop recently in this stock price has made this company compelling and hopefully with time, it will recover most of that market cap. That dividend is not too bad either so I'm willing to wait on this small position.

Basic info:

Nasty drop recently in this stock price has made this company compelling and hopefully with time, it will recover most of that market cap. That dividend is not too bad either so I'm willing to wait on this small position.

Basic info:

Market CAP: 90B EPS:$1.73 Dividend: $7.00 (3.3%)

Jul 20, 2018

Jul 17, 2018

Jul 13, 2018

Jun 22, 2018

Stock Purchase - Tanger Factory Outlet Centers (40 shares, $56 dividend income)

Tanger Factory Outlet Centers, Inc. (NYSE: SKT) is a REIT that owns and operates outlet centers in the United States and Canada with more over 2,600 stores representing approximately 400 store brands.

I'm adding more after last month's buy bcos it's discounted even more with that div approaching 6%.

The future for future of brick and mortar retail is gloomy for many but not all. People still love factory outlets and the more expensive brands seems to do well here.

This purchase will add $56 div income annually to my dividend stock portfolio 💪

May 3, 2018

Stock Buy - WBK (50 shares, $72 dividend income)

Westpac Banking Corporation (NYSE: WBK) aka Westpac, is an Australian bank and financial-services provider headquartered in Westpac Place, Sydney. It is one of Australia's "big four" banks.

As of November 2015, Westpac has 13.1 million customers, and is Australia's largest branch network, with 1429 branches and a network of 3850 ATMs. The bank is Australia's second-largest bank by assets. It is also the second-largest bank in New Zealand. (src: https://en.wikipedia.org/wiki/Westpac)

The US Federal Reserve is currently hiking interest rates and it will be a matter of time before worldwide central banks will follow. I believe strong financial institutions like big banks such as Westpac will benefit and thrive in this environment. Plus asian middle class immigration is booming there as well. I'm following the smell of money down under :))

This purchase will add $72 annual dividend income to my dividend stock portfolio

As of November 2015, Westpac has 13.1 million customers, and is Australia's largest branch network, with 1429 branches and a network of 3850 ATMs. The bank is Australia's second-largest bank by assets. It is also the second-largest bank in New Zealand. (src: https://en.wikipedia.org/wiki/Westpac)

The US Federal Reserve is currently hiking interest rates and it will be a matter of time before worldwide central banks will follow. I believe strong financial institutions like big banks such as Westpac will benefit and thrive in this environment. Plus asian middle class immigration is booming there as well. I'm following the smell of money down under :))

This purchase will add $72 annual dividend income to my dividend stock portfolio

Basic info:

Market CAP: 74B EPS:$1.73 Dividend: $1.44 (6.5%)

Mar 24, 2018

BTFD - Facebook

I'm "buying the f**king dip" on this bad news cycle which I think will pass in time and everyone will forget like usual ! :))

Feb 9, 2018

Selling a Loser - WPG (Washington Prime Group)

It's been a pain in the a** holding this retail REIT (NYSE:WPG) for the past year, watching it go down almost 50% from my buy point ! 😭 The whole retail REIT sector is under heavy selling pressure due to online competition - the Amazon Effect

However I'm still holding good long time quality retail REITs like Simon Property Group (NYSE:SPG), National Retail Properties (NYSE:NNN) and Tanger Factory Outlet Centers (NYSE:SKT) just to name a few. I'm betting the retail sector pie is big enough for everyone to share. I hope I'm right.

Feb 7, 2018

Adding more APPLE...

Recent stock market weakness provided a nice opportunity to add more. Their 1.6% dividend is looking good too. I also have a feeling shareholders will soon be rewarded with more buybacks and possibly dividend increases 💪👍🙏💰💰💰

Jan 26, 2018

Starbucks - Holding & Adding (21 shares, $25 div income)

Starbucks (NASDAQ:SBUX) has been sleeping past 2 years since I first bought in 2015. This is especially disappointing considering the broader stock market has been steadily going up past 4 years.

After today's revenue result disappointment, I bought more shares because their business is still very much profitable, though not to Wall Street's expectations. Steady income ~2 div yield with decent growth is OK with me especially considering their global brand is so strong. I'll bet they will probably outlive most of us in this lifetime !

This addition will add $25 annual dividend income to my dividend stock portfolio

Company Profile:

Market CAP: 82B EPS: $1.97 Dividend: $1.20 (2.07 %)

After today's revenue result disappointment, I bought more shares because their business is still very much profitable, though not to Wall Street's expectations. Steady income ~2 div yield with decent growth is OK with me especially considering their global brand is so strong. I'll bet they will probably outlive most of us in this lifetime !

This addition will add $25 annual dividend income to my dividend stock portfolio

Company Profile:

Jan 19, 2018

Stock Purchase - Store Capital (50 shares, $62 dividend income)

I added more Store Capital Corp (NYSE: STOR).

With yield above 5% and decent revenues, this is a steady income source.

I first bought this REIT last July.

This purchase will add $62 annual dividend income to my dividend stock portfolio

With yield above 5% and decent revenues, this is a steady income source.

I first bought this REIT last July.

This purchase will add $62 annual dividend income to my dividend stock portfolio

Jan 8, 2018

Jan 4, 2018

Subscribe to:

Posts (Atom)